Beating Non-food Inflation

Photos by Forrest Anderson; Graphics by Donna Rouviere Anderson

Two weeks ago, I wrote a blog on how to beat inflation in food prices. Since then, the annual inflation rate has risen to 7 percent, the highest since 1982.

Today’s blog follows up on ways to save on non-food items during the current inflationary period.

Prices are inflated because of escalating shipping prices, supply chain issues, higher labor costs, rising demand for transportation and products, shortages in computer chips, oils and chemicals and higher commodity prices. Some of the rise in costs are the result of pandemic disruptions, but economists have been predicting for some time that the era when the West could acquire inexpensive items from China was coming to a close because of higher labor costs in China and the environmental cost to China of producing cheap goods for western markets.

As a result, it doesn’t hurt for all of us to do a longer term reset on spending patterns that have been established over two decades of lower inflation, and move anti-inflationary strategies up in priority. Here are some ways we can do that:

Avoid Buying On Credit

Interest rates add to increased price costs and the indications are that interest rates are set to rise, so this is a good time to avoid buying items on credit as much as possible.

I recommended in the earlier blog spending an hour a week planning expenditures, because planning is important in inflationary times to avoid spending more.

Part of that hour can include strategizing ways to avoid going into debt and paying off existing debts. Using credit cards with rewards and paying them off monthly so you don’t have to pay interest rates also can help you to stay ahead of the inflation game.

Careful research before buying, maintaining what you have, substituting expensive items for less expensive ones that still do the job, making sure you need items before purchasing them, buying used items for less and waiting for deals before purchasing are all strategies that can save thousands of dollars and blunt the effect of inflation on your budget.

If you love to shop, turn some of your shopping time into this type of research and planning and make it into a game to see how much you can save and still have what you want and need.

This also is a good time to check your credit card statements and bank account to make sure you aren’t paying for subscriptions and services that you never use and forgot you had.

Gas

Retail gas prices jumped more than 58 percent last year – more than a dollar a gallon – with the average U.S. retail price for regular gas now about $3 a gallon. This is a seven-year high. Various forecasts for 2022 disagree on whether gas prices will moderate, indicating that the market is still volatile.

Supply chain bottlenecks and a spike in demand as more people have resumed driving could help fuel gas price increases.

Here are tips to save on gas:

- Check gas prices ahead of time on a fuel comparison app to find lower cost options. You can save $5-$10 per tank this way. This can help you save money on road trips in particular because some locations and states have lower gas prices. Gas can be higher priced in major tourist locations, so going another hour down the road before filling up can result in substantial savings in some places.

- Get more mileage out of a tank of gas by driving evenly, sticking to the speed limit and not using a roof rack, which can create drag that cuts down on your mileage. Speeding and unnecessary acceleration can reduce mileage by up to 33 percent. Make sure your tires are rotated and properly inflated to improve your gas mileage by up to 3 percent.

- Use the correct grade of motor oil and keep your engine tuned. Some maintenance fixes such as fixing faulty oxygen sensors can increase fuel efficiency by up to 40 percent.

- Many strategies to beat inflation also help lower carbon emissions – walking or riding a bike, carpooling and public transportation.

- Drive a car that gets good gas mileage and only drive the type of vehicle you need.

- Being stuck in traffic wastes gas and creates wasted CO2 emissions, so using traffic websites and apps to help avoid this can save gas.

- Combine errands to cut down on the number of trips you have to make.

- Remove excess weight from your trunk and use cruise control for better mileage.

- You also can save money on plane tickets by flying less frequently, traveling short distances when you do fly and flying economy class. Cutting down on longer far away vacations and taking more frequent drivable ones closer to home is another way to save.

Home Energy Use

Nearly half of households that heat with natural gas are projected to spend 30% more than they did last winter on their heating bills, according to the Winter Fuels Outlook 2021 report from the U.S. Energy Information Administration. Electricity users are expected to spend an extra 6%, according to the report.

Here are tips to save energy to beat inflation in your energy bills:

- Consider a home energy audit to spot and fix potential leaks and find areas for improvement, like sealing drafty windows. In some states, utility companies may offer the service for free.

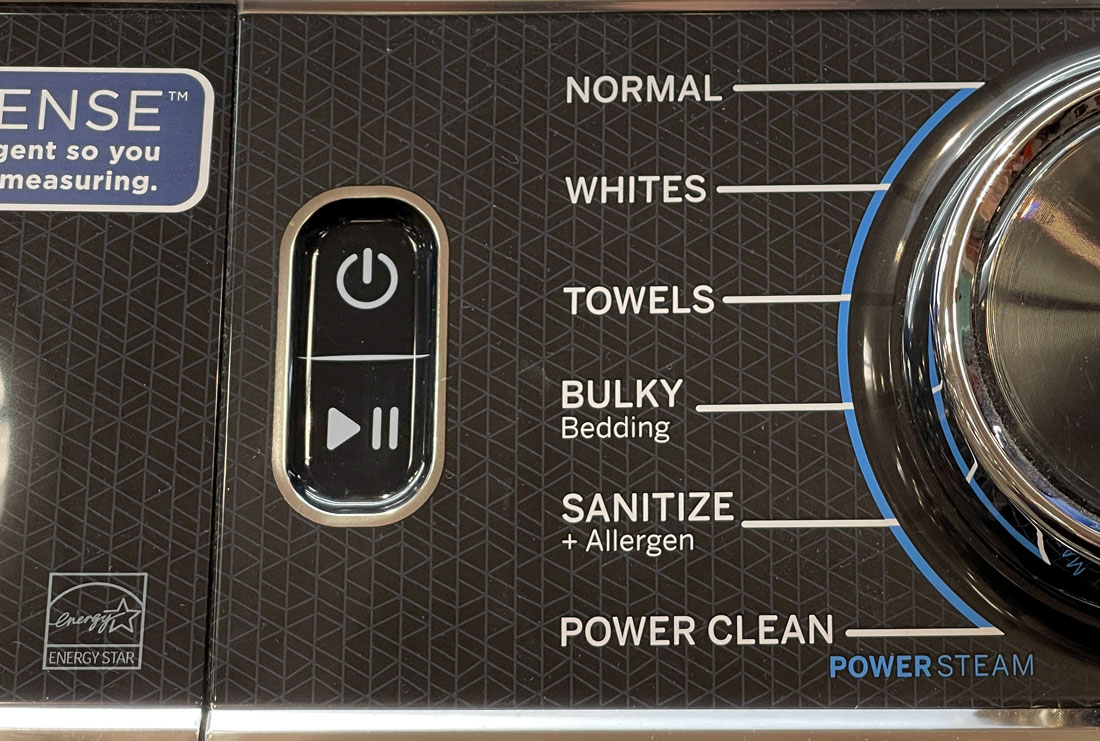

- Install water-efficient shower heads, faucet heads, toilets, furnaces, water heaters, air conditioning units, dishwashers and washing machines when you buy new ones. Look for the Energy Star logo on appliances and check the specifications to make sure they are energy efficient.

- Install inexpensive socket sealer foam inserts to insulate air gaps around your light switches and electrical outlets. You just remove the cover plates, place the inserts and replace the plates. This strategy can cut 10 percent off your energy costs.

- If your water heater doesn’t have an R-value of at least 24, you can save energy by putting an inexpensive water heater blanket on your water heater. Touch the heater to tell if this could help you. If it feels warm, it is heating the area around it and insulating it with a blanket will save energy.

- Smart power strips cost about $20 each and can reduce your power usage by automatically shutting down power to products that go on standby mode when you aren’t using them. Standby consumption for an average home can be as much as 5-10 percent of energy consumption.

- A programmable thermostat sets temperature settings to use less energy when a family is out of the home or sleeping. For the best results, don’t set it too high or too low.

- When buying a new furnace, air conditioning unit, refrigerator or dishwasher, get Energy Star ones for energy efficiency.

- Turn off lights that you’re not using and when you leave a room. Replace incandescent light bulbs with compact flourescent or LED ones.

- Add solar panels to the roof of your home. This may not save you money right away, but it will in the long run if you shop carefully for good deals.

Purchases of large ticket items such as appliances, cars and furniture

If you can, delay purchasing these items until prices drop again.

Prices for new cars and trucks are up 11.1 percent over the past year as a result of pandemic-related factory shutdowns and a computer chip shortage. Used-vehicle prices, however, have climbed 31.4 percent. This opens up an important opportunity to negotiate a higher price for your trade-in car or to sell on your own to offset the cost of inflation in a new car.

The inflationary environment in car prices makes it important to comparison shop, look for deals and negotiate carefully. You can get ten percent or more off for some vehicles if you do.

Furniture prices could rise by more than 10% in 2022 because of higher container freight rates and higher prices of building supplies.

Fortunately, decluttering your home and putting a fresh coat of paint on used furniture is an inexpensive way to solve many furniture problems.

With furniture, good quality used items can be substantially lower in price than new ones. I recently bought a custommade Italian leather couch for $150. The owner had purchased it for $1000 for a basement guest room before the pandemic and then had no guests because of the pandemic. He said the couch had been sat on about six times. This is probably less wear than a new couch in a typical furniture showroom would get.

When buying large-ticket items, think carefully about what you need. If you need a sofa sleeper for guests, then buy one. However, if you don’t, you can save a great deal of money by just buying a regular sofa.

We also have saved thousands of dollars by repurposing furniture. For example, we repurposed an old pine wardrobe that our children no longer used into a china cupboard with glass doors.

Some 29 percent of greenhouse gas emissions come from the processes of providing goods – extracting the resources, manufacturing, transportation, and final disposal of consumer goods, packaging, building components and passenger vehicles. By repurposing used products, you can save while reducing your carbon emissions.

Telecom and Internet Services

Many telecom and internet service providers suspended data caps and provided other breaks for consumers during the pandemic, but prices have started to rise and data caps have been reimposed in recent months.

To keep these costs down, low-income families may qualify for discounts on internet service and equipment through the federal Emergency Broadband Benefit program.

Other than switching to a lower-cost cell phone plan, the best option is to cut out cable TV services and extra subscriptions for entertainment services.

Many people also have lowered their bills by negotiating with their cable or internet company.

Health Care

The cost of health care has been a critical problem since long before the pandemic. Health care costs are up 8.4% from 2020, according to a medical index published by consulting firm Milliman.

This is one of the most difficult areas for individuals to save, and the best way to do it is to eat right and exercise regularly, as some of the most expensive illnesses such as diabetes type 2 and heart disease are preventable. Beyond that, careful planning and choosing health insurance depending on your health needs can save you thousands of dollars per year. For example, if you don’t normally need prescription drugs, you can save money by economizing on that health benefit. If you do need prescription drugs, you sometimes can choose generic ones to save money.

The American health care system is the world’s most expensive at an average of $10,000 per person per year. It represents almost 18 percent of the economy. A 2019 JAMA Network study found that some 20-25 percent of American health care spending – at least $760 billion per year - is wasteful. This is about the same as is spent on medical care for veterans, the Department of Education and the Department of Energy combined. Eliminating the waste could provide health insurance for 75 percent of the uninsured population.

Not all of the waste could easily be eliminated, but the JAMA study indicated that at least a fourth of it could, and it would reduce health care spending by about 5 percent without sacrificing health care quality. Much of the waste is in the administrative complexity of the American payment system. Moving to a single-payer system would eliminate most of this complexity, but would run up against powerful players who profit from the complexity. Switzerland, the Netherlands and a number of other countries with private insurance have much lower administrative costs than the United States because they have simpler administration.

Inefficient, low-value and uncoordinated care also costs at least $205 billion annually. This includes infections that patients get in hospitals, use of high-cost services when lower-cost ones would be sufficient, low rates of preventive care, avoidable complications, avoidable hospital admissions and readmissions and services that provide little benefit.

Although it is difficult for individuals to make a dent in these problems, they have become such a major national expense that there has been a surge in interest by high-tech companies in working on solutions that lower costs and make the health care system more efficient. Whether they succeed will depend at least partly on individual consumers who opt into more efficient systems so that this effort can gain momentum.

About 10 percent of waste in the health care system - $59 billion-$85 billion per year – is caused by fraud and abuse. These are areas where personal integrity can make a collective difference in costs.

Acquiring Smaller Items

Buy reusable Instead of disposable. Reusable products cost more upfront than their disposable counterparts, but they’re usually a better deal because they last much longer and are better for the environment.

Get free things from a Buy Nothing Group or get involved in other free swaps. Buy Nothing groups focus on donations rather than trading or bartering. You can join one on-line or start an informal one in your own neighborhood or church congregation. I once lived in a town where our church congregation had one. It was a simple group email. When someone was decluttering or remodeling, they could sent out a group email saying they had an extra mirror, five pairs of boys’ pants size 10, a child’s bike, old kitchen cabinets, extra tiles or other items free for the taking. People would email back if they were interested in an item and arrange to pick it up. It was first come, first serve. The person offering the item would then send out an email letting everyone know that an object was taken. The taker was expected to pick the item up within a day or two. No items were sold, so only those who wanted to give items away or get free items participated.

I participate annually in a large local clothing swap held a couple of weeks before the school year starts. It has been a godsend for people who need a good work wardrobe and it enables parents to share clothing that their children have outgrown and acquire new free clothing in their children’s current sizes. It’s a great source of free items such as prom dresses, bridesmaid dresses and confirmation dresses that have been worn just once and are practically new. All items are free, and the event creates the opportunity for good clothing that would otherwise go to a landfill to be recycled. Volunteers organize the event, so there is no financial overhead.

Clothing prices are expected to be up 3.2 percent this year because of supply chain prices. Before buying new clothes, it’s a good idea to go through your wardrobe and determine what is still useful as well as planning your wardrobe carefully and looking for sales on classic, good quality clothes that will last.

Shop in Your Local Classifieds

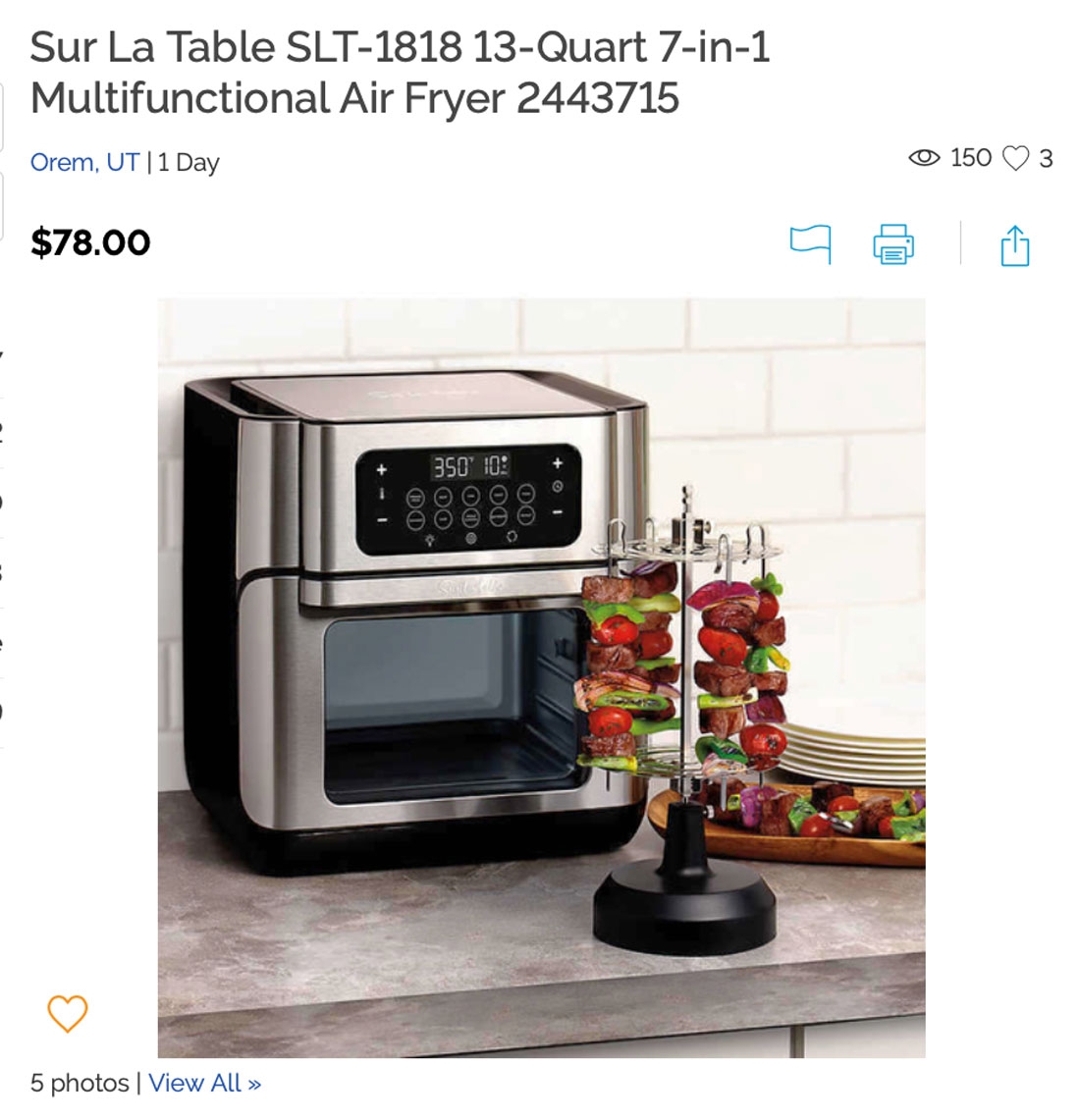

I saw a combination air fryer/portable oven at Costco this week for $119.

Out of curiosity, I got on my local television station’s classified section and found the same item for $78. It was brand new and had never been taken out of the box. The website had five pages of similar items, probably half of them brand new for an average of $30 or more less than the standard retail price at stores.

It is surprising how often you can get an item on the classifieds that is new or as good as new with a low price tag. Buying used items and items from classifieds requires planning and careful choices, but it saves money and allows you to live at a much higher level for your budget than purchasing new items. It also is better for the environment, because you are recycling items that otherwise could be thrown away.

The key to buying used items wisely is to identify good-quality ones that will last and shop until you find one in new or good condition for a low price.

This also can be a good way to get building materials, as many people have them left over after a remodel or building project and are happy to sell them at a discount.

Yard Care

Save money paying for water by using climate-appropriate plants in your yard and installing timed drip irrigation so plants receive only what they need.

Housing

This is the biggest headache for most people. Home prices are expected to continue to appreciate this year across all U.S. cities, although the growth will be less dramatic and there will be fewer bidding wars. This could make it easier for some home buyers to at least get their foot in the door. Rent prices also are expected to continue to rise, making home buying still a good strategy.

The key to saving money in this situation is to be very clear about what you want and need and what you don’t, and to be careful about finances in other areas so that when a house that is ideal comes on the market, you can act quickly to acquire it.

If you already have a home and don’t need to purchase a new one right now, it might not be the most optimum time to buy unless you come across a very good deal.

Eating Out

Restaurants have had ongoing staffing shortages and most have had to raise prices to attract workers in the past year. They also are paying more for food ingredients. That means that prices on their menus are going up.

You can save on eating out by doing it less often and looking for weekly specials and deals when you do eat out.

Computers and electronics

Computers, TVs and video game consoles have all been hard hit by an ongoing chip shortage and that means there’s much less inventory, even if you are willing to pay higher prices.

Some the best computer sales of the year are around Presidents’ Day when retailers mark down last year’s models to make room for this year’s offerings. Prices aren’t likely to come back down even when supply finally catches up with demand, so it’s worth taking the time to shop around and make sure you know what features you need and what ones you can do without. It may be a good time to forego a 15-inch computer for a 13-inch one. I did that several years ago to save money, and found that I much prefer the 13-inch model for its portability and lighter weight.

The bottom line for beating inflation is careful planning and consideration of what you need and what you don’t as well as shopping carefully for deals. This makes it sound like the party is over in terms of consumers being able to purchase much of what they need for relatively low prices.

That is not the case. The U.S. economy remains enormous, robust and capable of delivering a wide array of goods at reasonable prices. The current situation just means that those who are more careful planners and shoppers and who shop for real value and to meet their needs and wants rather than succumbing to marketing pressures will be able to maintain and even improve their standard of living as prices rise.

Check out these related items

Enough Stuff App

The Enough Stuff inventory app for iOS helps you keep track of how much you have of items so you don't buy more of them than you need.

Home Gnome App

The iOS app that helps you keep track of what tasks you need to do and when to do them to maintain your home well all year long.

Green Thumbometer App

The all-in-one iOS app that's a gardening calendar, gardening journal, gardening to-do list and source of gardening information.

How to Fight Inflation of Food Prices

Inflation, health concerns and climate change are at the top of the news. Wise food shopping and consumption can help with all three.

Inventory App and Sticker Dots

Use sticker dots and an easy inventory app, Enough Stuff, to keep track of your food supplies, toiletries and other stuff of all kinds.

Easy Home Maintenance App

Two home owners created the Home Gnome app to track when to do home maintenance tasks. The iOS app is available at the App Store.

A Minimalist Tries Marie Kondo

A confirmed minimalist finds that Marie Kondo's tidying method helps her to refine an understanding of what brings joy.

Sustainable Clothing

The trade war with China. Environment degradation. Household debt. To bring all of them into focus, we can look in our closets.

Creating an Easy Cooking System

Creating a simple, versatile cooking system can enable you to serve delicious meals at home even on days when you are swamped.